Understanding Commercial Rent

Commercial rent is calculated quite differently than residential rent. There are some basics about commercial rents that we must know.

Commercial Rent Basic Terminlogies

Base Rent

TMI – Property Tax, Maintenance and Insurance

Gross Rent

HST

How to Calculate Commercial Rent?

The base rent, sometimes called net rent, is the rent to lease the commercial property. The TMI includes property tax, maintenance and insurance. In a NNN (triplet net) lease, the landlord is only responsible for the structural repair and the general maintenance is the responsibility of the tenants. The tenants also pay for the property tax and property insurance. Gross rent in the sum of the base rent plus the TMI. Lastly, HST is paid on top of the commercial rent.

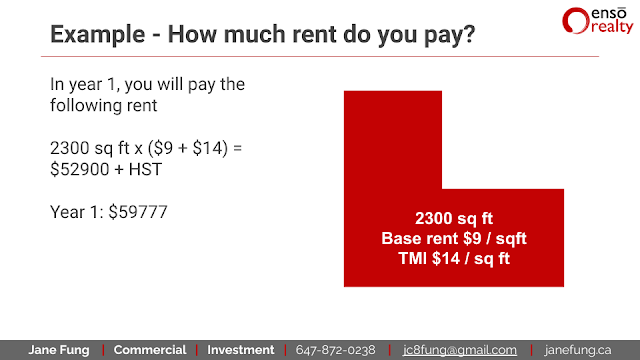

Example of Calculating Commercial Rent

Let’s pretend a tenant is renting a commercial unit that is 2300 sq ft. The base rent is $9 / sq ft and TMI is $14/sqft. How much rent does the tenant pay?

2300 sq ft

Base rent $9 / sqft

TMI $14 / sq ft

In year 1, the calculation is as follow:

2300 sq ft x ($9 + $14) = $52900 + HST

Year 1: $59777

Does the tenant pay the same rent on Year 2?

The answer is No.

How is Commercial Rent Yearly Increase Work?

Typically, yearly increase is already built into the original lease contract. It might be something like this.

Rent Per Sq Ft

Year 1 – $9.00

Year 2 – $9.50

Year 3 – $10.00

Year 4 – $10.50

Year 5 – $11.00

So it means the 2nd year, the base rent increase to $9.5 per sq ft

In addition, the TMI will also change. Let’s pretend the TMI is increased to $16 per sq ft

Year 2 rent will be 2300 sq ft x ($9.5 + $16) + HST = $66274.5