What is Lifetime Capital Gains Exemption in Canada?

In Canada, small business owners who sell shares of their small business corporation may be eligible for the Lifetime Capital Gains Exemption (LCGE), which can help them save on taxes. This information is based on the current guidelines provided by the Canada Revenue Agency (CRA). However, it is important to note that tax laws can change, so it is always recommended to consult the CRA or a tax professional for the most accurate and up-to-date information.

To illustrate how the LCGE works, let’s consider an example involving a childcare centre owner who is a Canadian citizen and owns all the shares of the small business corporation running the childcare centre. After many years of operating the centre, the owner decides to retire and sell the business. In this scenario, the owner might be eligible for the LCGE, which can potentially save them up to 50% of the capital gains tax they would otherwise have to pay. It’s crucial to consult with an accountant or tax professional to understand the specific details and requirements.

Please keep in mind that the above information is a summary of what is found on the CRA website at the time of writing. To obtain the most accurate and up-to-date information regarding the Lifetime Capital Gains Exemption and its application to your specific circumstances, it is always advisable to refer to the official guidelines provided by the Canada Revenue Agency (CRA) or seek assistance from a qualified tax professional.

This property in Ajax presents an exceptional opportunity for sale, catering to both church and daycare purposes. Spanning approximately 2289 square feet of interior space, this property is zoned I-A, emphasizing its suitability for both church and daycare use. The substantial parking availability further enhances its appeal, accommodating the needs of visitors and occupants. With an asking price of $3.2 million, this property stands as a promising prospect for those seeking a versatile space that aligns with church and daycare functions.

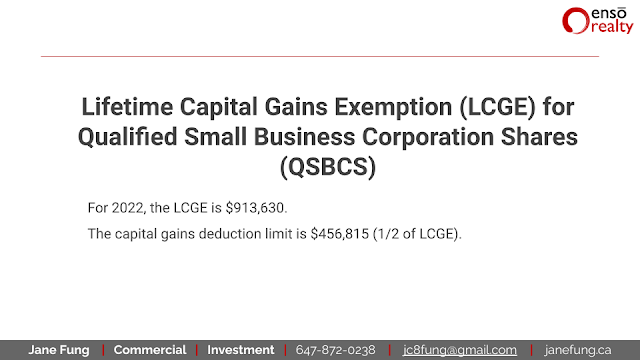

Lifetime Capital Gains Exemption Per Year

The Lifetime Capital Gains Exemption (LCGE) for Qualified Small Business Corporation Shares (QSBCS) are as follows for different years:

- In 2022, the LCGE is $913,630. The capital gains deduction limit is $456,815 (1/2 of LCGE).

- In 2021, the capital gains deduction limit is $446,109 (1/2 of LCGE).

- In 2020, the capital gains deduction limit is $441,692 (1/2 of LCGE).

- In 2019, the capital gains deduction limit is $433,456 (1/2 of LCGE).

- In 2018, the capital gains deduction limit is $424,126 (1/2 of LCGE).

- In 2017, the capital gains deduction limit is $417,858 (1/2 of LCGE).

- In 2016, the capital gains deduction limit is $412,088 (1/2 of LCGE).

- In 2015, the capital gains deduction limit is $406,800.

Capital Gains Inclusion Rate

In 2022, only 50% of the capital gain from the disposition of property is taxable.

The same inclusion rate applies in previous years.

Claiming the Deduction

In a given year, you can claim any amount of the capital gains deduction up to the maximum allowable amount calculated based on the LCGE and applicable limits.

Qualified Small Business Corporation Shares

To qualify as a small business corporation share, the share must:

- Belong to you, your spouse or common-law partner, or a partnership of which you are a member at the time of sale.

Be a share of the capital stock of a small business corporation. - Throughout the 24 months immediately before the share was disposed of, the following conditions must be met:

- The share must be a share of a Canadian-controlled private corporation.

- More than 50% of the fair market value of the corporation’s assets must have been used mainly in an active business carried on primarily in Canada by the Canadian-controlled private corporation or a related corporation.

- The assets can be either used mainly in the active business, certain shares or debts of connected corporations, or a combination of these two types of assets.

- Throughout the 24 months immediately before the share was disposed of, no one other than you, a partnership of which you are a member, or a person related to you should have owned the share.

Who is Eligible for Canada Lifetime Capital Gains Exemption?

To be eligible to claim the capital gains deduction:

- Residence in Canada: You must be a resident of Canada throughout the tax year for which you are claiming the deduction, in this case, 2022.

- Alternative residency criteria: The Canada Revenue Agency (CRA) will also consider you to be a resident throughout 2022 if you meet both of the following conditions:

- You were a resident of Canada for at least part of 2022.

- You were a resident of Canada throughout the preceding tax year, 2021, or the subsequent tax year, 2023.

CRA Website References: