This article explains the CWELCC allocations. It is based on the CWELCC 2025 guidelines, which may change as the government updates its policies. It is important to always refer to the latest official government documents. You can find these in the First-Time Operator Checklist for the most up-to-date information.

Example Scenario

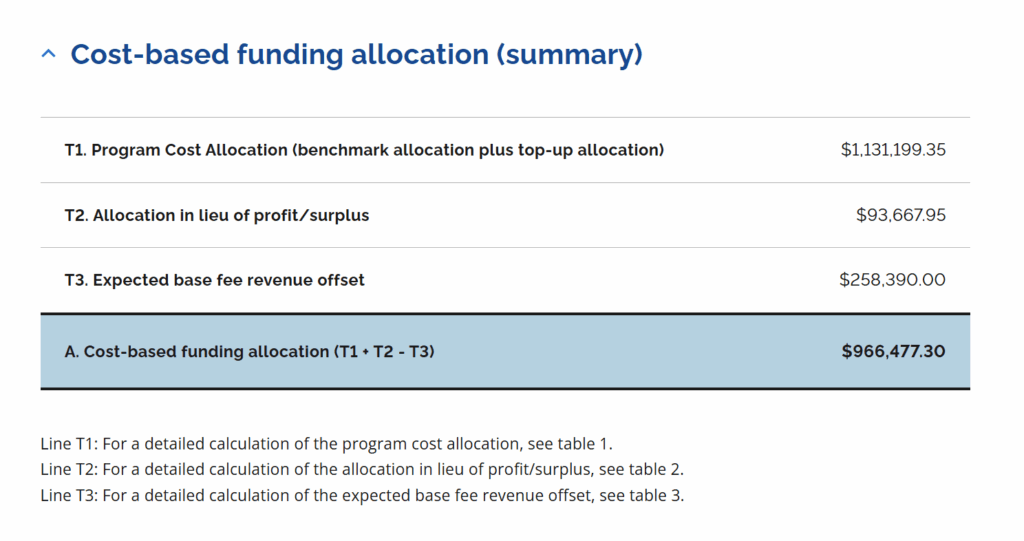

Let’s take an example of a private centre in Toronto with 15 toddlers and 35 preschoolers.

- CWELCC Allocation: $966,477.30

- In-lieu of Profit (Surplus): $93,667.95

- Parent Fees: $258,390

What Does This All Mean?

How CWELCC 2025 Works

Under CWELCC 2025:

- The government reimburses all eligible expenses.

- The operator receives a 7.75% profit (“in-lieu of profit”) calculated on approved expenses.

For a full detailed explanation, see:

Explaining CWELCC 2025 to New Operators

Translating CWELCC to Accounting Terms

In standard accounting:

Revenue – Expenses = Profit

In the CWELCC model:

- Revenue is the allocation, which already includes the profit.

- The allocation is calculated using a fixed formula based on the number of children, age groups, and location multipliers (Toronto has different multipliers than other regions).

You can see how to calculate your allocation using:

Estimating Your 2025 CWELCC Funding: A Step-by-Step Guide

Can I Claim More If My Costs Are Higher?

Since not every centre will have the exact same expenses, there is a “top-up” process.

If your expenses exceed the estimated allocations, you may receive be approved for top-up for the additional amount. However, top-up approval is not a guarantee.

For the next funding year, you will submit your updated expenses such as lease, property tax and insurance reflective of the next funding year, and any top-up request.

Example Breakdown Using the Correct Figures

Using the example:

- CWELCC Allocation: $966,477.30

- In-lieu of Profit (Surplus/Profit): $93,667.95 (this is your 7.75% profit)

- Parent Fees Collected: $258,390

Since parent fees partially cover operational costs, the government allocation will cover the remainder of eligible expenses.

In CWELCC language: “in-lieu of profit” = profit.

There is a 10% discount to the parent fees because the government assume there is a vacancy of 10%.

Director’s Management Fee

CWELCC allows operators to claim a management fee (up to $120,000 annually), but:

- If you own multiple centres, you can only claim this once per year, not per centre.

- It must be paid as T4 employment income, not as a dividend.

Summary

Under CWELCC:

- Your total revenue is your $1.13M + $94K = $1.22M.

- Your “profit” is the in-lieu of profit ($93,667.95).

- Parent fees ($258,390) reduce how much the government pays but do not reduce your profit and this amount of more will be paid by the parents.

- Your eligible expenses are fully covered by the combined parent fees and government funding.

- You receive your 7.75% profit on top of covered expenses.

Effectively, as an owner, your income under CWELCC is your management fee + 7.75% profit, while all eligible expenses are reimbursed.