We include the year 2025 in this discussion because the CWELCC program may change in 2026, which could significantly affect how businesses are valued.

As of 2025, net profit under CWELCC is capped at 7.75%. This cap directly impacts business valuations, since profit is a key driver in determining the worth of a business.

Using Multipliers to Value a Business

When valuing a business, a common approach is to use a profit multiplier. This means multiplying the business’s annual net profit by a factor—known as the multiplier—to estimate its value.

For example, if a business generates $180,000 in profit and we apply a 4X multiplier, the estimated valuation would be:

$180,000 × 4 = $720,000

This figure represents the amount a buyer might be willing to pay if they expect to recover their investment (break even) within four years.

Normalizing Net Profit

When calculating net profit for valuation, we often normalize it. This means adjusting for items that are specific to the current owner but would benefit a new buyer—such as the seller’s management salary.

A more refined formula for business valuation might look like this:

(Normalized Net Profit + Seller’s Management Fee) × Multiplier

This approach gives a more realistic picture of the income a buyer could expect to receive. However, this is still just a very rough estimation because these are before tax and it ignores any other possible add-backs that might be added back to the net profit.

Tax Considerations

It’s important to note that this calculation is based on pre-tax profit, and management fees are typically paid as salary (T4 income), which may be taxed at a higher personal rate. This method provides a good ballpark figure.

For a more technical calculation such as using EBITDA or normalized EBITDA, you can refer to this article by Alex Reznikov who is an accountant who specializes in childcare centres.

https://www.childcarecpa.ca/post/ebitda-metrics-for-childcare-centre-transactions

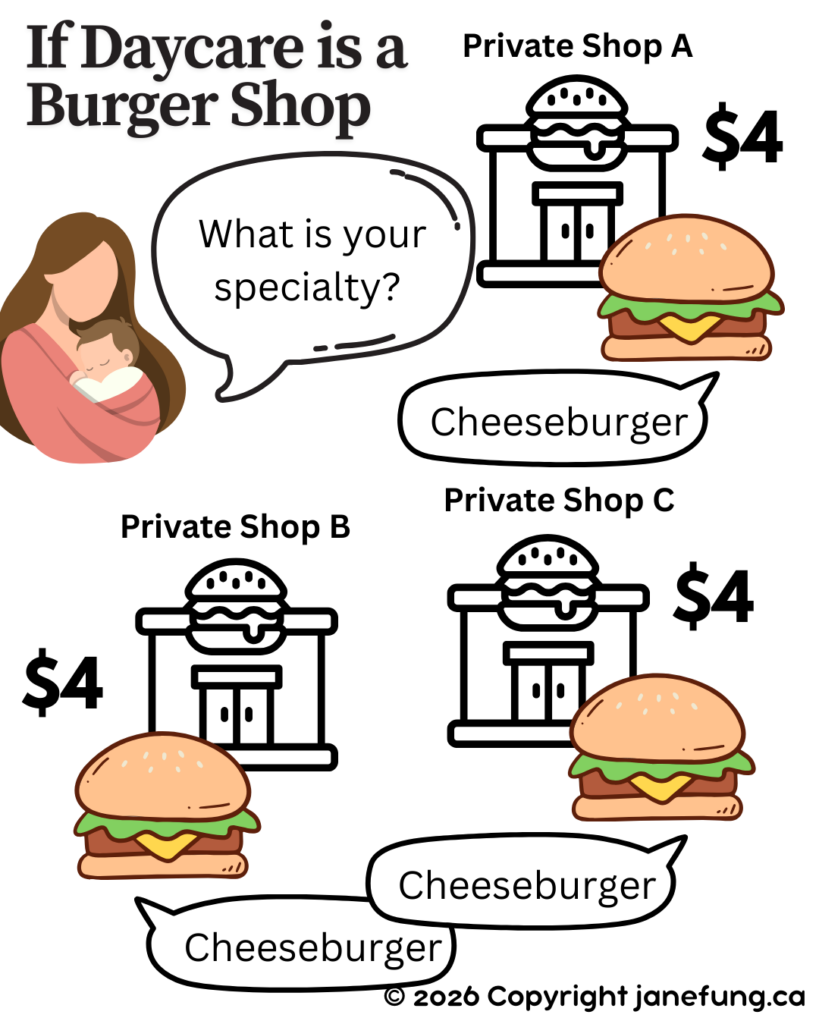

Market Realities

While the methodology above provides a starting point, market value ultimately depends on what buyers are willing to pay.

Recent transactions suggest that CWELCC businesses are selling at multipliers around 3.5 times, though this can fluctuate as funding programs evolve and buyer demand shifts.

If you’re a seller hoping for a higher multiplier – say, 6 times – you must find a buyer willing to meet that price. Otherwise, you may have to wait a long time to sell and might eventually settle for a price closer to 3.5 to 4 times multiples.