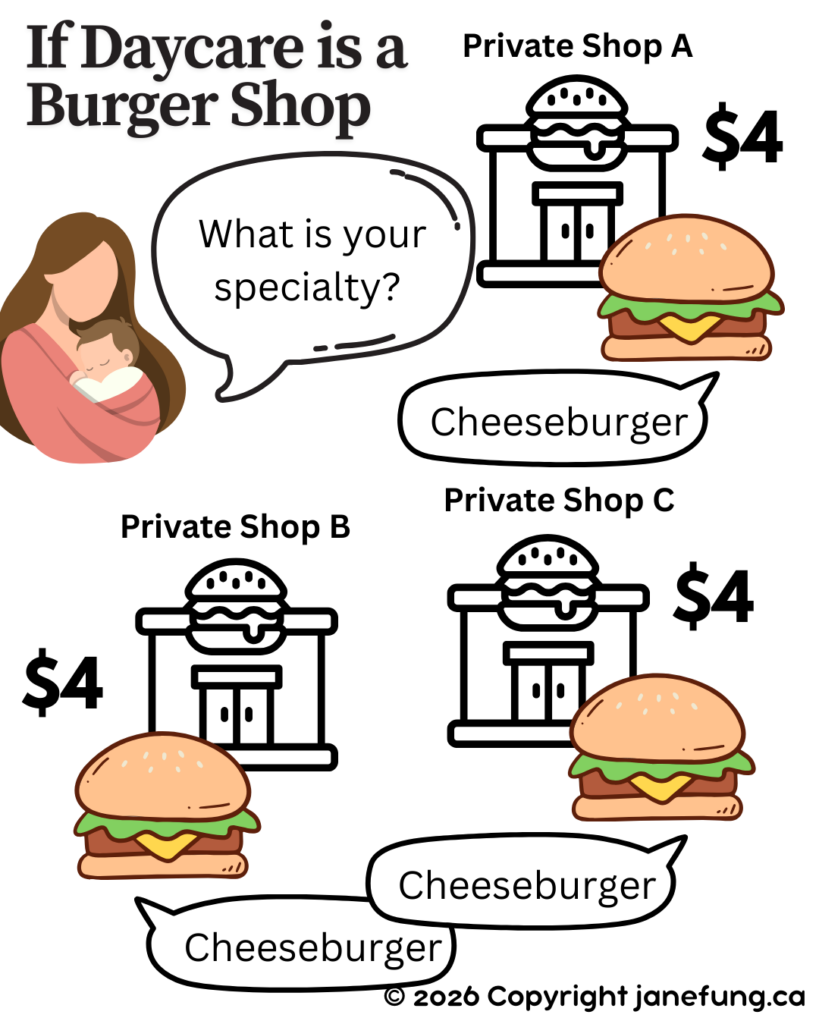

If you are a daycare operator, you already know that running a daycare can be a rewarding and profitable venture. However, like any business, there are often limits to your profit potential due to various factors such as rent, overhead costs, and the increasing pressure of regulations. But what if there was a way to increase your wealth while continuing to do what you love—teaching and nurturing young minds?

One powerful wealth-building strategy that many business owners overlook is owning the property where their business operates. Think of the property like a piggy bank: Instead of depositing your hard-earned money into the Landlord’s piggy bank, why not invest in your own?

The Cost of Renting

As a daycare operator, you’re likely paying a significant portion of your revenue in rent each month. This rent covers not just the use of space but also the landlord’s expenses, including property taxes, insurance, and maintenance. Essentially, every month you’re contributing to the landlord’s wealth rather than your own. That’s money that could be working for you, building equity in a property you own.

Why Owning Makes Sense

Let’s break this down further: Each month, your daycare business is paying a significant amount in rent to the landlord. Instead of giving them that massive monthly check and covering their expenses, why not redirect those funds into something of your own—like purchasing the property? When you own the building, those same monthly payments go toward paying down your mortgage, and eventually, the property becomes an asset that you own free and clear.

This is not just about avoiding rent—it’s about building long-term wealth. Over time, your property will likely appreciate in value, adding to your net worth. And if you ever decide to sell your business or retire, owning the property can provide you with a valuable asset that could be sold or rented out, ensuring continued income.

Furthermore, you are not going to be subject to the rent increase by the Landlord at the end of the lease. Many operators faced double or triple rent increases and they had absolutely no choice but to pay them.

Future-Proofing Your Business

This strategy becomes even more important as regulations like the CWELCC (Canada-Wide Early Learning and Child Care) 2025 model roll out. With the cost-based reimbursement model on the horizon, there will be limitations on how much you can earn as profit. By owning your property, you can conserve your profit in a different way.

When profit margins are limited, every dollar saved or invested wisely counts more. Owning the property you operate from ensures that you have control over a significant portion of your overhead costs, protecting your business from rent hikes and allowing you to focus on providing excellent care rather than worrying about escalating expenses.

Building Wealth, One Brick at a Time

Investing in real estate is a time-tested method of building wealth, and as a daycare operator, it makes even more sense. By owning the property where you run your daycare, you not only create stability for your business but also build a personal asset that appreciates over time. It’s a long-term strategy that helps you build wealth with your passion for teaching while securing your financial future.

So, instead of continuing to put your money into someone else’s piggy bank, why not take that step toward owning your own property and building your wealth one brick at a time?