Are you finally gotten too tired of running a childcare centre and started thinking about selling it? This article is to explore the topic to see if your childcare centre is financially appealing to buyers and how buyers evaluate your childcare centre financially.

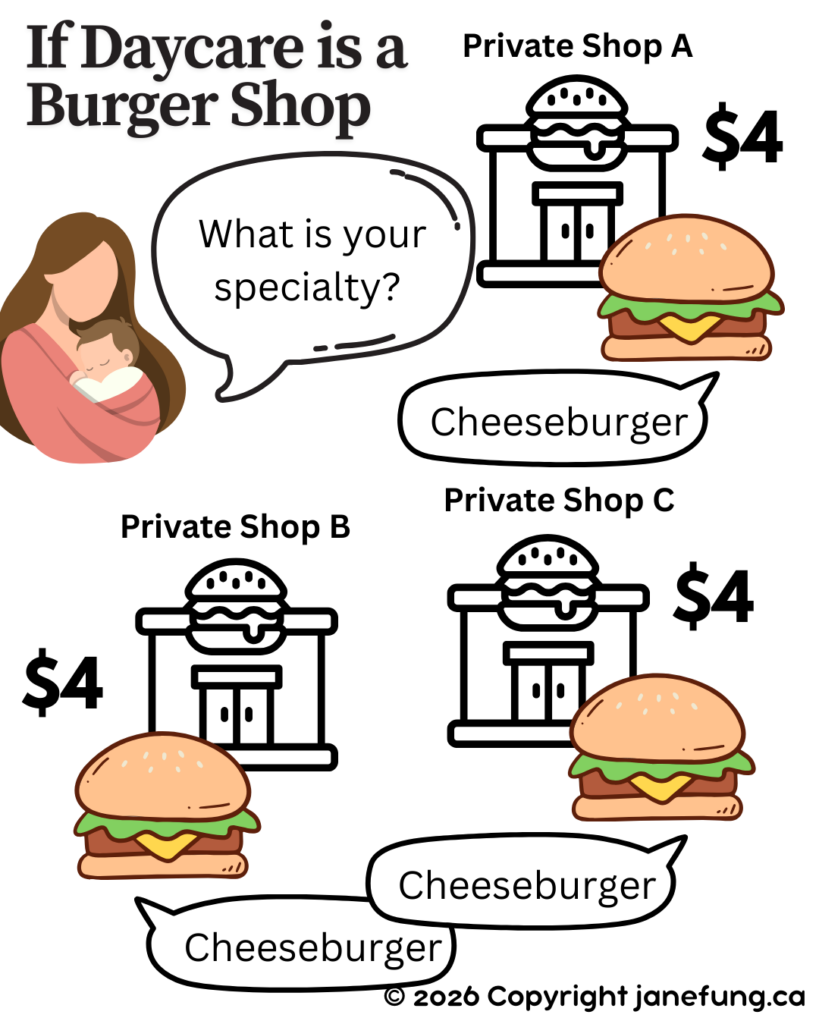

When a buyer evaluates a business, everyone evaluates a little differently, but most buyers would want to purchase a business that is already making money and not one that is failing and losing money. However, it doesn’t mean that there are no buyers for failing businesses; there are just not as many buyers in that arena, and sellers should not expect to get the same price as those who are succeeding.

Some of the terminologies that buyers use are like net profit, EBITDA, margin, breakeven. Let’s take a look at what each of them means. Since many sellers are not in accounting, some of these terms become diluted and meaning skewed, so we can only use the information provided as a high-level comparison. The deep validation still should be done by the accountant.

Net Profit

Net profit from the financial statement, also referred to as net income or the bottom line, is a key measure of a company’s profitability. It represents the amount of revenue that remains after all expenses, including operating expenses, interest, taxes, depreciation, and amortization, have been deducted from the total revenue. So that’s what the company’s left over after all expenses and taxes are deducted.

EBITDA

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It’s a financial metric that’s commonly used to evaluate a company’s operating performance and profitability. Essentially, EBITDA provides a clearer picture of a company’s profitability by excluding certain expenses that can vary between different businesses or may be influenced by factors unrelated to the core operating performance.

Net Profit Margin

A Net Profit Margin is the percentage of revenue that remains after deducting all expenses, including COGS, operating expenses, interest, taxes, depreciation, and amortization. It reflects the overall profitability of a company.

Break Even

When a buyer is considering purchasing a business, the break-even point refers to the point at which the total costs of acquiring and running the business are recouped through its operations. It’s the point in time when the business begins to generate enough revenue to cover all the costs associated with acquiring and operating it.

What Buyers are Looking For

Buyers will typically ask for the net profit or the EBITDA or something that indicates the revenue, expenses, and profit. Sellers should provide clear pictures of how things are. Often, sellers might pay themselves a lot of salary, which reduces the net profit. Those are things that the seller can work with their accountant to come up with a normalized version so that the buyer can see a better picture when the seller is no longer involved in the business and not taking such large salaries.

Buyers would typically want to buy a business that can break even in a reasonable number of years. The number of buyers will decrease if it takes more years to break even. Meaning that if the buyer spends $1.2M to purchase a business, they expect to get that $1.2M back in a certain number of years and then start making a profit in the remaining years.

Let’s say a buyer wants to break even in 3 years, which is a very reasonable time. Then what it means is that the business must be making $400K in profit so that the buyer can recoup their investment in 3 years and then start making money for the rest of the years while they own the business.

While collaborating with your accountant, it’s crucial to address the complexities surrounding government grants, many of which are pre-paid. Achieving an accurate representation of true profit may necessitate additional effort in reconciling these grants. For instance, if the government has disbursed more funds than warranted, potential repayments could diminish your childcare center’s profit. Buyers are likely to scrutinize this aspect closely. Inability to provide monthly reconciliation evidence and lacking clarity on advances and payables in financial statements could raise concerns for buyers. The absence of government grant reconciliation might be perceived as a red flag, signaling potential financial irregularities.

If a business is not making money, this calculation might not be good for the buyer. However, a different evaluation could be used to calculate how much the business is worth to a potential buyer by evaluating the licenses and assets. This is another topic that will not be covered in this article.

At the end of the day, before selling, sellers should work with their accountant to get the numbers for EBITDA, profit, net project sorted out so that they can present a correct picture to potential buyers.

In addition, you should expect that the buyer will perform a forensic investigation into your financials as part of their Due Diligence.