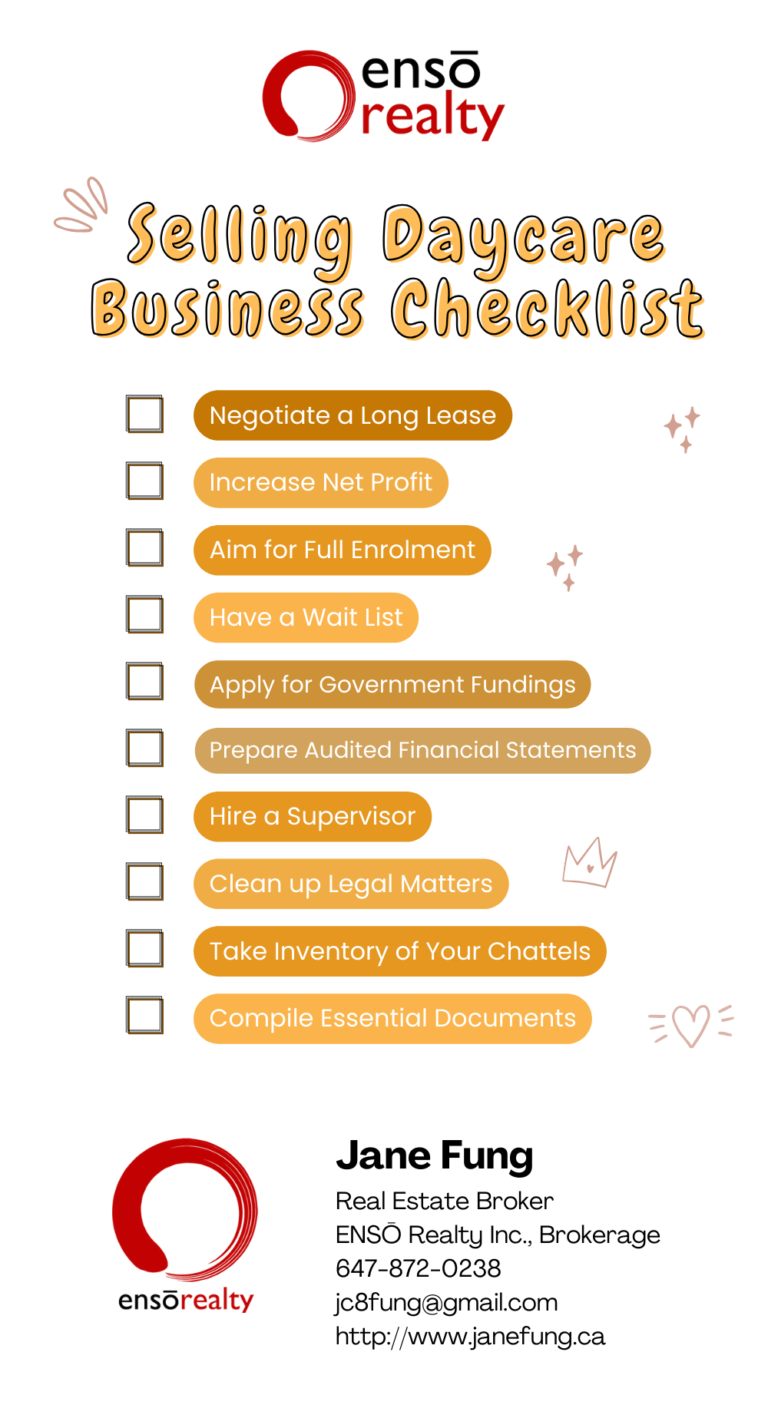

Prepare your Business for Sale

If you’re contemplating selling your childcare center business, it’s essential to prepare it for maximum appeal to potential buyers and lenders. When selling a typical house, you’d clean, fix any issues, and set it up to fetch the best price possible. Similarly, when selling a business, the idea is to make it buyer-friendly and appealing to financial institutions, even though the preparation may not involve painting and staging.

Many sellers often fail to consider the buyer’s perspective. If you briefly step into their shoes, you’ll understand what buyers are looking for and what they need. They seek a profitable business with a strong foundation that can secure financing from banks. Breaking even within 2 to 3 years and generating profits afterward is crucial for a worthwhile investment. For instance, if your business has a net profit of $200,000, and you’re asking for $2 million as the selling price, this would mean the buyer has to run the business for 10 years before reaching breakeven, which is an unlikely scenario for most buyers.

Therefore, it’s advisable to focus on the following aspects when contemplating the sale of your daycare business two to three years in advance:

1. Long Lease and Favourable Terms

One of the most critical factors in the sale of a daycare business is the lease agreement. If your lease is approaching expiration, perhaps with only three years remaining, it can significantly hinder your selling prospects. Potential buyers may be deterred from considering your business because a purchase with such a limited lease term is financially impractical.

If you find yourself in a situation where your lease is nearing its end, it is advisable to proactively engage with your landlord to secure a long-term lease, ideally spanning 10 years with another 5 years of renewal options. If possible, negotiating a reasonable low rent would be a valuable advantage. If not, ensuring the lease specifies a fair market rent can safeguard the buyer from a sudden increase in rent after they take over.

Additionally, consider including a first right of refusal clause in the lease agreement. This clause grants the tenant the initial opportunity to purchase the property if the landlord decides to sell. By incorporating this provision, the potential buyer, upon taking over the lease, not only gains the benefit of an extended lease term but also enjoys other advantageous terms and conditions.

2. Increase Net Profit

Daycare owners often find themselves in a position of substantial income generation, which can sometimes lead to unnecessary expenditures. It is crucial to identify and curtail these unnecessary costs to enhance profit margins before selling the daycare business. When a bank decides to finance the buyer and provide them with a loan for their business, they place significant importance on examining the financial statements. Even if the buyer recognizes that many of the expenses can be reduced, if these potential savings are not reflected in the financial statement, the bank may not consider them as add-backs. Therefore, improving the profit on the financial statement is crucial to demonstrate the profitability on paper that the bank can directly utilize.

Moreover, consider implementing strategies to bolster your revenue streams. For instance, contemplate the possibility of enhancing your online presence through website improvements, offering virtual tours to prospective clients, or executing more effective advertising campaigns. These initiatives can contribute to further financial growth and business success and you might want to kick off these initiatives before consider selling the business.

3. Full enrollment

Ensuring your daycare centre maintains near-full or full enrollment during the sale process is crucial. This not only signifies the viability of your business but also enhances its overall appeal to potential buyers and lenders. A daycare centre operating consistently at or near capacity demonstrates stability and reliability. It showcases a track record of meeting the community’s childcare needs, providing assurance that the business can continue to thrive. Furthermore, it offers a steady income stream, instilling confidence in prospective buyers and financial institutions that the daycare can cover operational costs and debt obligations.

Additionally, high enrollment levels indicate strong demand for your daycare services, hinting at a built-in customer base and growth potential. This consistency reinforces the effectiveness of your business model, assuring buyers that they are investing in a well-established and profitable venture. It also increases the likelihood of securing financing from lenders who prefer businesses with a demonstrated ability to generate consistent revenue. In essence, maintaining robust enrollment levels not only aids in selling your daycare business but also showcases a thriving and dependable enterprise ready for continued success under new ownership.

4. Have a Wait List

Creating and maintaining a waiting list for your daycare centre is a strategic step that significantly bolsters the appeal of your business to prospective buyers and investors. It serves as compelling evidence of the strong demand for your services, offering a built-in customer base, ensuring revenue stability, and presenting a competitive edge in the market. This waiting list not only underscores the quality and reputation of your daycare centre but also provides an invaluable asset during the sale process, reinforcing the business’s desirability and potential for continued success under new ownership.

5. Get all the Government Fundings

Seeking government funding for daycare centres is essential, as these programs can substantially alleviate operational expenses, ultimately increasing the bottom line, and make the daycare more appealing for potential buyers. By actively applying for various available funding opportunities, daycare providers can benefit from financial relief, allowing them to invest in better-trained staff, improved facilities, and enhanced learning materials. This, in turn, enables the provision of more competitive and attractive childcare services, making tuition fees more affordable for parents and increasing enrollment. Moreover, government funding contributes to the long-term viability and financial stability of daycare businesses, fostering community engagement and trust while ensuring high-quality childcare services for families.

6. Audited Financial Statements

To prepare your daycare business for sale, it’s imperative to ensure that your financial records are meticulously maintained, accurate, and well-organized. These records encompass profit and loss statements, balance sheets, tax returns, and cash flow statements. Not only does this showcase that your business is profitable, but it also plays a crucial role in facilitating the acquisition process, especially when it comes to securing loans from banks. If your financial statements show a robust profit, it not only demonstrates your business’s profitability but also strengthens the buyer’s ability to obtain necessary financing. Conversely, if your financial statements appear weak and don’t align with your claims regarding certain expenses, it may hinder a buyer’s chances of securing a loan from the bank. Banks heavily rely on what’s documented on paper when assessing loan applications.

During the due diligence phase of a business purchase, you will be required to provide various financial documents for the past four years, including financial statements, tax returns, and bank statements. To instill greater confidence in potential buyers and lenders, it’s advisable to consider investing in audited financial statements. In some instances, depending on your revenue or regulatory requirements, audited financial statements may be mandatory. These audited statements not only offer an extra layer of credibility but also enhance the overall appeal of your daycare business, making it a more attractive investment opportunity for discerning buyers.

7. Hire a Supervisor

Consider appointing and training a dedicated supervisor if you currently oversee your daycare business. This step can transform your operation into a turnkey model, simplifying the transition for new buyers and maintaining continuity for both staff and parents. A capable supervisor can ensure seamless day-to-day operations, staff management, and consistent care quality, adding significant value for potential buyers who seek stability and reliability in childcare services.

Having a supervisor in place also demonstrates that your daycare business is self-sustaining, reducing its dependency on your personal involvement. This can greatly boost buyer confidence in the business’s long-term potential, making it a more appealing investment. In summary, hiring and training a supervisor enhances your daycare business’s appeal, streamlines transition, and fosters continued success under new ownership.

8. Clean Up Legal Matters

Prior to selling your daycare business, it is crucial to resolve any outstanding litigation, disputes, or compliance issues while ensuring that all essential contracts, permits, licenses, and leases are meticulously organized and in proper order. This diligence not only enhances the overall appeal of your business but also mitigates potential obstacles that could deter prospective buyers.

Another critical element in the process is to address your corporate documentation thoroughly. When selling shares, it is imperative to ensure that your daycare business possesses essential corporate documents such as Articles of Incorporation and comprehensive minute books. Some daycare owners may find themselves lacking proper property by-laws and minute books, in which case it is advisable to engage legal counsel to create these documents. This proactive step ensures the existence of comprehensive records, including minutes and board meeting documents. These documents are necessarily when you sell your business.

9. Take Inventory of Your Chattels and Fixtures

This is a crucial step when selling your business. The purchase agreement will include a schedule that requires you to list all items within the daycare that will be sold along with the shares. This list should also specify the chattels and fixtures that are both included and excluded in the sale. It’s a meticulous and time-consuming process, so it’s advisable to get a head start to avoid any time constraints during the offer negotiation phase.”

10. Begin Compiling Essential Documents

When purchasing a business, buyers typically require a due diligence period during which they will need access to a variety of documents to complete their assessment. While you likely have these documents scattered in various places, it can be beneficial to start compiling them electronically into one organized location. This proactive step will facilitate easy sharing when you’re ready to sell. The necessary documents may encompass a Site Plan and CAD, Survey and CAD, Floor Plan, Property Tax Bills, Fire Approvals, Playground Inspection Reports, Water Testing Results, a List of all Contracts related to the Building and Business, Leases, Financial Statements, Tax Returns, Bank Statements, and any other relevant paperwork associated with the childcare center.

By meticulously addressing these aspects, you can present your daycare center as an attractive and well-prepared investment opportunity. This strategic approach will undoubtedly maximize your daycare center’s market value and set the stage for a smooth and lucrative sale.

Download and Share Infographics