In the commercial real estate world, you may encounter both leasing and subleasing opportunities. Understanding subleasing can offer flexibility and potentially cost-effective solutions for businesses.

What is a Sublease?

A sublease occurs when an existing tenant, known as the sublessor, rents out all or part of their leased property to another party, called the sublessee. This arrangement doesn’t replace the original lease but operates under its terms, with the sublessor remaining responsible to the head landlord. Subleasing can be an attractive option for businesses looking to secure space without the long-term commitment or higher costs of a new direct lease.

What you want to note is that when you sign the sublease, the original tenant will become your sublease-landlord. And you will be paying the sublease-landlord the money and TMI. Also, in the original lease, the original Landlord might have clauses that limit if the space can be subleased or that the head landlord might have to approved the sublease-tenant. You should seek a legal counsel to review both the original head lease and also the sublease to ensure your rights are protected. Furthermore one of the risk is that if the sublease-landlord fails to pay the headlease landlord even though you might be paying the sublease landlord. The headlease landlord can still kick out hte subleaselandlord which will adversely affect your operations.

Why Consider Subleasing?

There are several reasons why businesses might choose to sublease. It can provide significant cost savings, especially if the sublease was locked in at a lower rate than current market prices. Additionally, subleases often come with flexible or shorter terms, which can be ideal for companies in transition or those hesitant to commit to long-term obligations. Many subleased spaces are also ready-to-use, already furnished, or equipped, which can reduce setup costs and downtime.

Why Would Someone Sublease Their Unit?

Conversely, tenants might sublease their space for various practical reasons. Companies that are downsizing, relocating, or restructuring may find themselves with extra space they no longer need. Rather than breaking their lease and facing penalties, subleasing allows them to recover some of the costs. For businesses in financial strain or dealing with underutilized space, subleasing offers a way to offset expenses without relinquishing their lease obligations.

Is Subleasing the Entire Unit or Just Part?

Subleasing is not limited to entire units; it can involve renting out a portion of the space. For example, a company downsizing its operations may choose to retain part of the premises while subleasing the rest to another business. This partial subleasing can create a win-win situation, allowing both parties to share costs and resources. Alternatively, subleasing the entire unit is common when a business relocates or shuts down operations but still has time left on its lease.

Advantages and Disadvantages of Subleasing

Like any business arrangement, subleasing comes with both advantages and disadvantages. On the positive side, subleases often present cost-effective opportunities, especially if the sublessor secured a favorable rate years ago. The flexibility of shorter terms can appeal to companies needing temporary space or testing new markets. Additionally, many subleased spaces are turnkey solutions, meaning they are already furnished or equipped, saving time and money on setup.

However, there are also potential downsides. Subleases are bound by the terms of the original lease, which can limit control and introduce constraints. The remaining term on a sublease might be short, creating uncertainty for businesses that need long-term stability. Moreover, subleasing often requires approval from the head landlord, which can add complexity to the process. Companies must also consider the risk that the sublessor may default on their lease obligations, which could jeopardize the sublease arrangement.

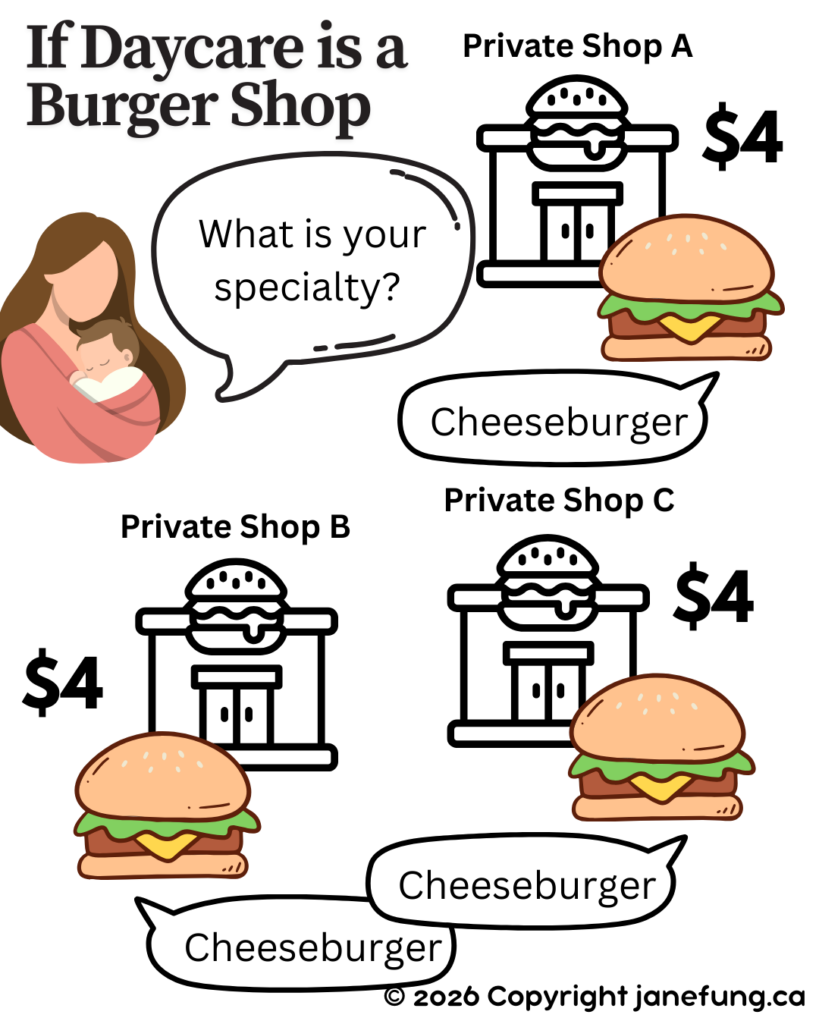

Direct Lease vs. Sublease: Which is Better?

A common question arises: why not negotiate directly with the head landlord instead of subleasing? While a direct lease offers long-term stability and control over the terms, it may come at a higher cost and require a longer commitment. Subleasing, on the other hand, can offer significant savings, especially if the existing lease was signed at a lower rate than current market prices. However, subleases might have limited time left on the contract, which could necessitate renegotiation or relocation in the near future.

It’s also worth noting that some sublessors may discourage direct communication with the head landlord to maintain control over the agreement and avoid complications. In these cases, it’s important for potential sublessees to thoroughly understand their rights and obligations under the sublease agreement. Careful due diligence and legal review can help ensure that the sublease arrangement is beneficial and free from hidden pitfalls.

Key Considerations and Risks in Subleasing

When entering a sublease agreement, it’s essential to recognize that the original tenant becomes your sublease-landlord. This means you’ll be paying rent and any additional costs, such as taxes, maintenance, and insurance (TMI), directly to the sublease-landlord rather than the head landlord. However, the original lease often includes clauses that can impact the subleasing process. For example, the head landlord might impose restrictions on subleasing or require approval of any potential subtenant.

To protect your interests, it’s crucial to seek legal counsel to review both the original head lease and the sublease agreement. This ensures that you understand all obligations and rights, preventing potential conflicts down the line. One significant risk to be aware of is the possibility of the sublease-landlord defaulting on their obligations to the head landlord. Even if you fulfill your financial responsibilities by paying the sublease-landlord on time, the head landlord can still terminate the lease if the original tenant fails to meet their obligations. This could lead to eviction and disrupt your operations, highlighting the importance of due diligence and thorough contract review before entering any sublease arrangement.

Conclusion

In conclusion, subleasing can be a strategic move for businesses seeking flexibility and cost savings in the commercial real estate market. However, it requires careful consideration of the terms, potential risks, and long-term implications. By understanding the intricacies of subleasing, businesses can make informed decisions that align with their operational and financial goals.